In this blog post, we will describe strategies to manage commission advances and repayments. We describe a clear logical model (used by Sales Cookie) to make it easy to track and handle advances and repayments.

Advances and Repayments – Definitions

Let’s define the following commission terminology to gain some clarity:

- An advance is a positive recoverable commission amount. Such as advance is recoverable because it must be repaid in the future. An advance increases paid commission amounts, but also increases a rep’s owed balance.

- A repayment is a negative commission amount. Such a repayment is justified because you issued prior advances which must be repaid. A repayment decreases paid commission amounts, but also reduces a rep’s owed balance.

- The owed balance is the sum of (positive) advances and (negative) repayments. The balance represents the amount owed by a rep to an organization. Since repayments should never exceed advances, a rep’s balance cannot be negative.

Here is a basic example:

- A +$100 advance was granted in January

- The owed balance is $100

- A +$50 advance was granted in February

- The owed balance increases to $150

- A -$120 repayment was made in March

- The owed balance is reduced to $30

This is a simple example. In practice, the “history” of advances and repayments may be more complex, with multiple advances, partial repayments, forgiven advances, etc.

Why Advances?

Most organizations prefer NOT to issue commission advances because a/ it creates financial risk and b/ it adds complexity to commissions. However, there can be very valid reasons for issuing commission advances:

- A rep received negative commissions in a given period (ex: due to customer refunds). However, reps cannot quite pay you (the employer), so you need to provide an advance to “pad” their commissions to zero. This advance, only intended to avoid negative commissions, will need to be repaid later on.

- You know that a deal will go through. Although the deal hasn’t closed yet, you want to make an exception and pay a commission earlier to motivate the rep. This advance will need to be repaid from future commissions (ex: from commissions received when the deal finally closes).

- A rep is eligible for a recoverable draw – a commission guarantee. For example, you guarantee $1,000 per month in commissions. If a rep only earned $800 in a given period, you must grant them a $200 advance to meet their $1,000 guarantee. This advance will need to be repaid from future commissions exceeding the guarantee.

- You are transitioning from one incentive model to another. For example, you are switching from paying commissions upfront (when deals close) to paying commissions when payment is collected. This can cause a temporary drop in commission earnings. An advance can serve as a bridge payment method.

We can identify two types of advances:

- Manual – the advance is an exception which is handled manually (it should still should be recorded)

- Automatic – the advance can be calculated automatically based on a rule

- Example: a rep has a guaranteed minimum commission of $1,000 per period

- The system should add whichever amount is necessary to meet the guarantee

Why Repayments?

If you have recoverable advances, then naturally you need repayments.

We can identify two types of repayments:

- Manual – the repayment is an exception which is handled manually (it should still should be recorded)

- Automatic – the repayment can be calculated automatically based on a rule

- Example: repay the balance as much as possible, as long as commissions don’t fall under zero

- Example: repay the balance, but by no more than $500 each month to spread out repayments over time

Managing Advances

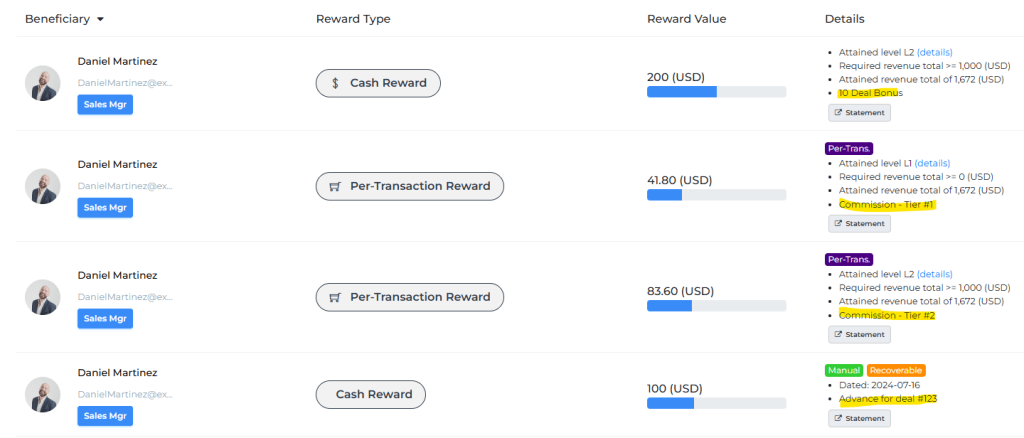

Suppose that a payee received the following rewards in June commissions:

- A regular reward worth $41.80, from 8 deals in Tier #1, with a 5% commission rate

- A regular reward worth $83.60, from 4 deals in Tier #2, with a 10% commission rate

- A bonus worth $200, for closing more than 10 deals in the month

- A recoverable reward worth $100, which is therefore an advance

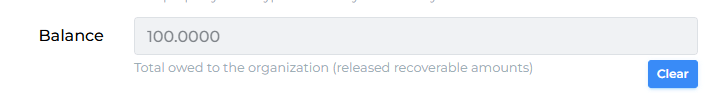

The total payout for this period is $425.20, out of which recoverable rewards are $100. As a result, in January, the rep’s balance increases from $0 to $100. We can see this on payee dashboards:

On the user’s profile, we can see that the owed balance is now $100.

In the example above, the $100 advance was added manually with explanation “Advance for deal #123”. However, we could also choose to calculate advances automatically. In the example below, we define a commission guarantee. The system will automatically add positive recoverable rewards to ensure the guarantee is met. In this example, the guarantee is configurable on a per-payee basis.

Managing Repayments

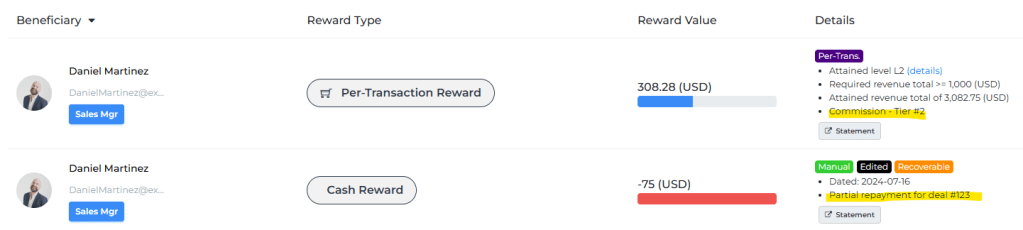

Suppose that a payee received the following rewards in July commissions:

- A regular reward worth $308.28, from 5 deals in Tier #2, with a 10% commission rate

- A recoverable reward worth -$75, which is therefore a partial repayment

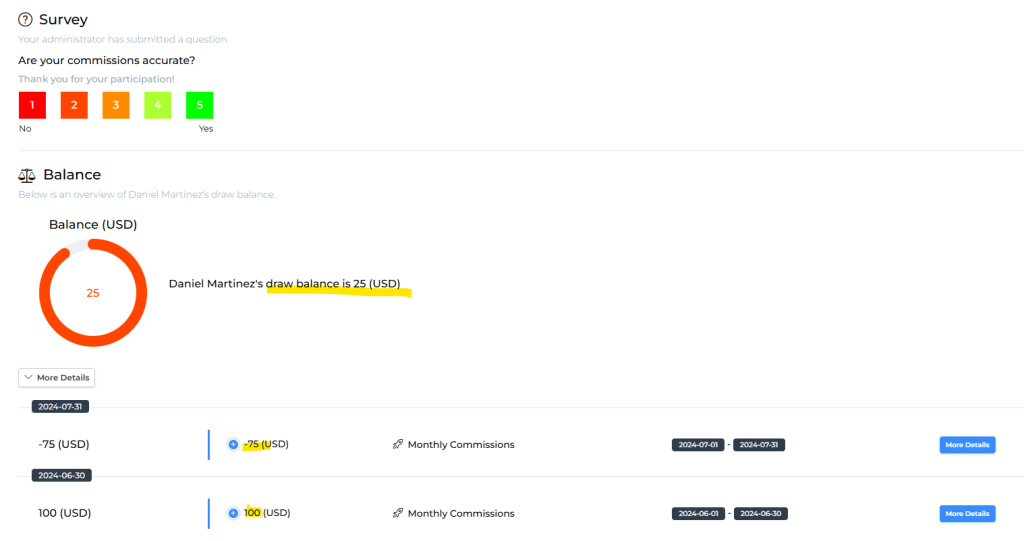

The total payout for this period is $233.28, with recoverable rewards being -$75. As a result, in January, the rep’s owed balance decreases from $100 to $25. We can see this on payee dashboards:

On the user’s profile, we can see that the owed balance is now reduced to $25.

In the example above, the -$75 repayment was added manually with explanation “Partial repayment for deal #123”. However, we could also choose to calculate repayments automatically. In the example below, we define a repayment policy. A guarantee has a fixed value of $1,000, with a repayment cap of $500 (to spread out repayments). The system will automatically add negative recoverable rewards to ensure repayment, as long as reps earned more than $1,000. However, repayments will not exceed $500 each period to give reps enough time to repay their balance.

Helping Reps Track Advances and Repayments

We can help reps understand the history of positive and negative “movements” to their owed balance using widgets or tables. For example, here is what it may look like using the same examples as above. We can see a $100 advance in June and a -$75 repayment in July.

Handling More Complex Commission Advances and Repayments

We can use more complex formulas to calculate advances and repayments. See this recipe for more background information.

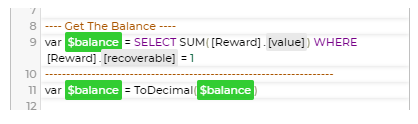

For example, we can calculate how much is owed by calculating the sum of recoverable rewards:

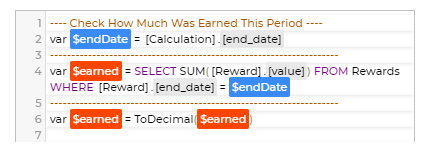

We can also check how much was earned in commissions in the current period:

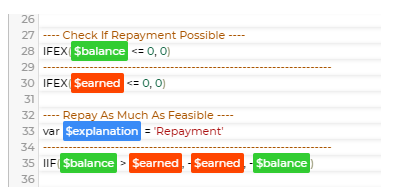

And compare the two to determine how much can be repaid:

This example is very simple (we repay as much as possible), but the logic could be more complex depending on your exact advance and repayment rules. The sky’s the limit!

Here are examples of more complex rules:

- Advances stop after some time

- Advance amounts vary over time

- Commissions earned from some sources cannot be used for repayment

- Repayments must be repaid as per a specific schedule

- Etc.

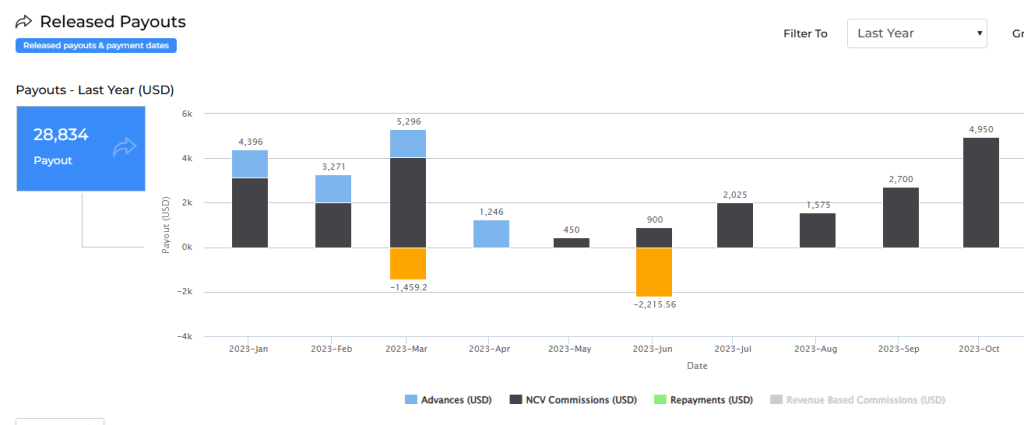

The example above shows an anonymized example where advances are granted (positive, in blue), commissions are earned (in black), and then advances are repaid (negative, in orange).

In Conclusion

Sales Cookie is familiar with advances and repayments. We’ve built a clear model, widgets, recipes, and tools to handle all possible scenarios. If you are tired of tracking advances and repayments manually – or lack transparency, consider automating your commission process. Visit us online – we’d love to help!