We totally get it! As a Sales Operations professional, a lot of your time is spent calculating commissions, resolving disputes, gathering sales data, and keeping your team happy and motivated. Without a commission automation solution, they represent a significant work burden because you have to manually generate and distribute commission spreadsheets.

You don’t necessarily have a lot of time to spend on the following:

- Fully documenting your sales commission structure

- Ensuring all edge cases are handled & documented (ex: termination)

- Requiring all reps to formally review and accept incentive plans

- Establishing a legal authority to change incentive plans

We’re sorry you are already working so hard to keep up with commissions with little time to spare. And yet… failing to account for the above can prove costly. In this blog post, we’ll discuss some real-world legal risks, and ways you can easily bulletproof your sales incentive program.

Sales Commissions – Legal Risks

This press release “Oracle Hit with $150 Million Class Action Over Lost Commissions” is a textbook example of the risks associated with ignoring some legal aspect of commissions. Here is another article discussing this costly debacle.

What happened:

- Oracle presented an original commission plan to its employees

- Reps received “earned commissions” based on this plan (more on this risky terminology later)

- Later, Oracle retroactively updated plan parameters (ex: quotas / rates)

- Oracle calculated commission clawbacks representing overpayments made to reps

- Those clawbacks were treated as debt – to be repaid by reps from future commissions

- Reps felt shortchanged and filed a class action lawsuit to keep their “earned commissions”

Here is one interesting claim in the lawsuit:

Oracle routinely decides to change commission formulas so as to reduce commission payments on past sales, well after the commissions have been earned and even sometimes after they have been paid

So what went wrong with with Oracle’s commission process?

- They failed to clearly define what “earned commissions” meant (more on this soon)

- They failed to explicitly establish their authority to update commission plans

Drafting a Solid Commission Agreement

To limit risk, you must first draft a precise commission agreement, which reps must formally review and accept. In the example below, we’re generating a legal agreement from Sales Cookie‘s legal commission plan editor. We’re also injecting each rep’s customized quota into the plan’s description (@@Quota is a placeholder whose value is different for each rep). This ensures legal agreements are always up-to-date.

Handling Edge Cases

The 10 paragraphs we added above already cover important edge conditions – leave of absence, recoupment of awards, departures, etc.

You need to be a bit paranoid. Or, at least, you need to think about how things could go wrong. Here is a quick checklist to help you to draft a robust sales incentive agreement.

- Reserve administrative rights to…

- Make changes to rules, quotas, rates, tiers, structures, etc.

- Handle “bad data”, such as duplicate transactions, incorrect amounts, omissions, etc.

- Resolve disputes, such as disagreement about commission splits, deal eligibility, etc.

- Reject orders, deals, etc. as non-commissionable, at your discretion

- Interpret plan rules and parameters when ambiguous

- Define plan eligibility

- Who is on what plan?

- Who qualifies for draws, the quarterly bonus, accelerators, etc.?

- Are sales interns eligible for commissions?

- Do reps need to be employed for a minimum amount of time?

- What if employee titles change mid-period?

- Define what happens if employees leave, are terminated, are demoted, or go on a leave of absence

- What happens if a rep won a deal (with an “earned” commission), but is no longer employed when the deal finally closes / payment is received? You may want to indicate that such “earned” commissions will not be paid.

- What happens to quotas if an employee goes on a leave of absence? Could they argue that quotas should be pro-rated? If they are a manager and go on leave, do they still get credited for sales from working team members?

- What happens if a sales manager is demoted, promoted or transferred (ex: from territory manager to account executive, from one territory to another)? Do employees need to work a minimum amount of time in a role to be eligible for payment?

- Allow recoupment of payouts

- Think about refunds, partial payments, bad debt, etc.

- Authorize clawbacks for certain situations (incorrect data, bad debt, etc.)

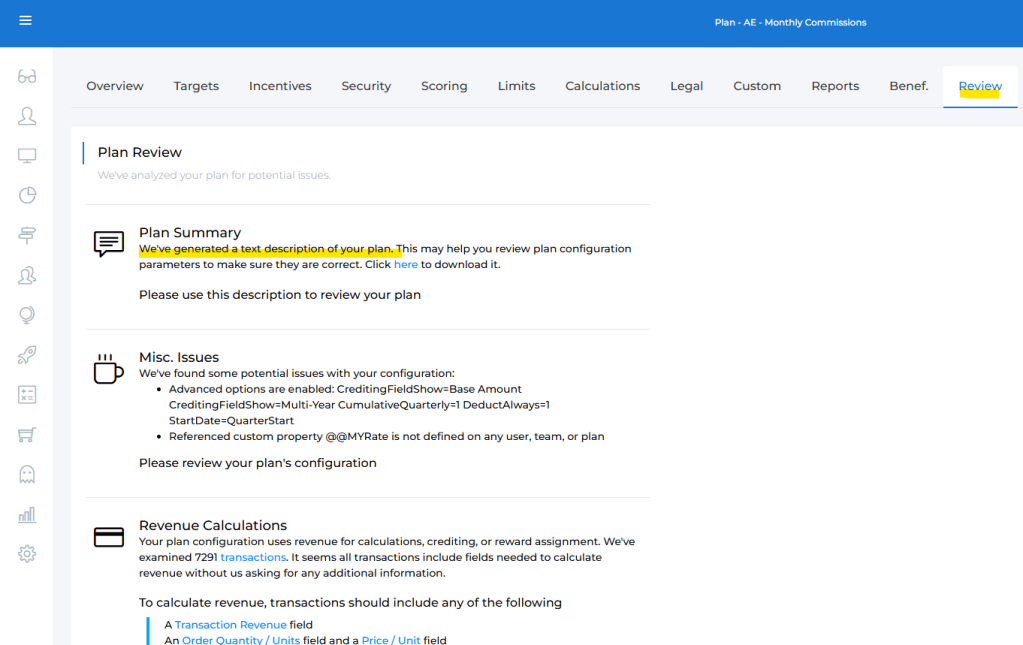

Add a Plan Description

Obviously the “meat” of your agreement should be a clear description of your commission structure. Using Sales Cookie, we can configure plans and automatically generate text descriptions.

Here is an example of a generated auto-description:

This is too technical and should be simplified for the legal agreement, but at least it provides ALL details:

- Who is eligible for this plan?

- What is the payment frequency for this plan?

- What is the effective date for this plan?

- What is the attainment metric?

- How are MY (multi-year) deals handled?

- Are tiers cumulative or non-cumulative?

- Are splits allowed?

- Are there any caps?

- Etc.

We highly recommend clarifying how tiers work. This is a very common source of confusion and disputes!

- As a reminder, there are two main tier variants (more info here). Cumulative tiers work like tax brackets. Each deal is paid at the rate corresponding to the tier. Non-cumulative tiers are different. Only the highest attained tier matters. All deals are paid based on the highest attained tier.

- Your reps really need to understand how your tiers and accelerators work. We recommend including a table, walking them through a simple example, so there is zero confusion about tiers.

- This is also very important if for example you have a quarterly quota with monthly commissions. Reps may expect a true-up at the end of the quarter, but if your tiers are cumulative, a true-up does not apply.

Also, avoid using the “earned commissions” terminology like the plague!

- Many organizations issue potential commissions, for example when a deal is won, or invoice is opened. The actual commission will be paid later on – when the deal closes or the invoice is paid.

- Some organizations call those potential commissions “earned commissions”, because they expect the commission to be paid later on. However, this terminology sets certain expectations and creates legal risk. For example, if the terms of a deal change, reps may argue they should be paid the original amount they “earned”.

- We highly recommend calling those commissions “estimated commissions” or “potential commissions”. Avoid “pending commissions” as this sets expectations similar to those of “earned commissions”.

- In Sales Cookie, we always label all potential commissions as “estimated commissions”, but you can change the terminology (example below). We always use special color-coding to distinguish estimated commissions from actual commissions. This helps mitigate legal risk.

Getting Reps To Enroll & Accept

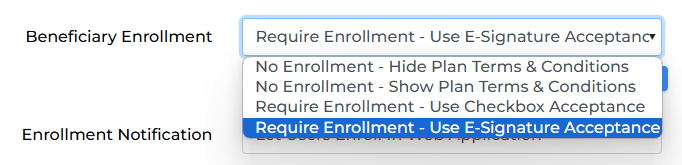

Now, you need to get reps to accept. There are different aspects to this.

How do they accept? Do they send you an email? Do they sign electronically? Do they check a checkbox? In the example below, we define an acceptance method.

How do they enroll? How do you track who has enrolled and who hasn’t? Do payees get daily reminders to enroll? Can managers see who has enrolled and who has not? In the example below, we can define a notification method.

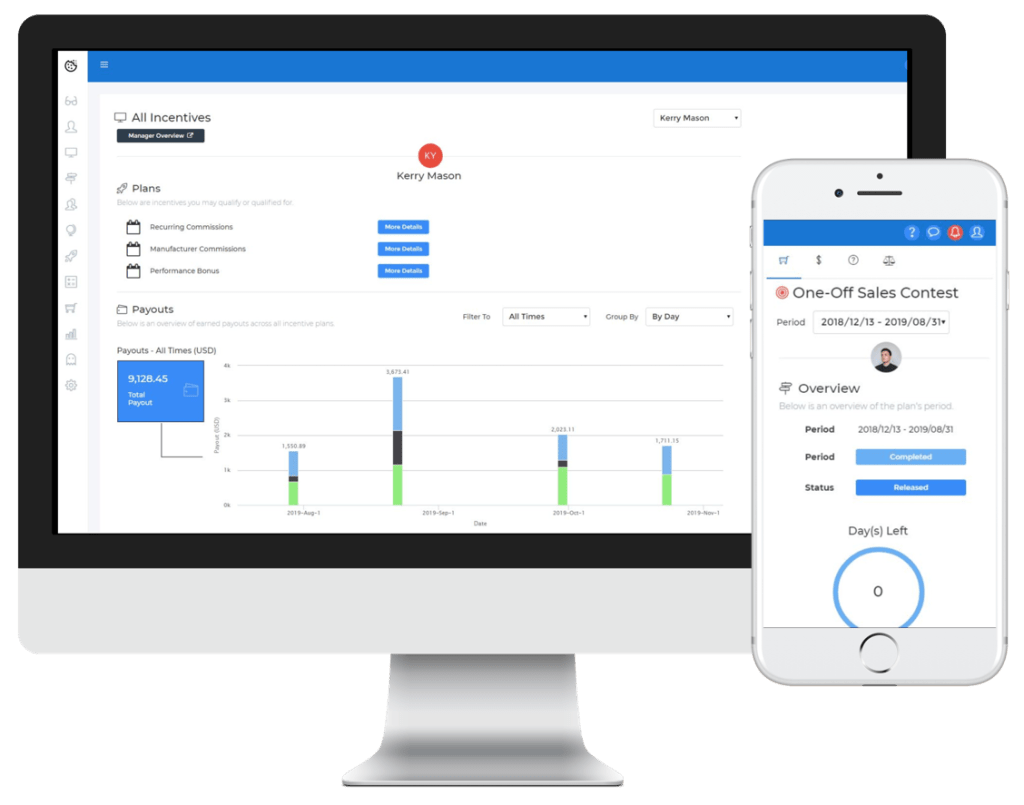

Above are examples from Sales Cookie. We can automatically manage the following:

- Collecting e-signatures

- Sending reminders to payees to accept

- Capturing acceptance from payees

- Injecting placeholders into statements (ex: quotas, rates)

- Showing agreements on payee dashboards

- Alerting admins when agreements are missing

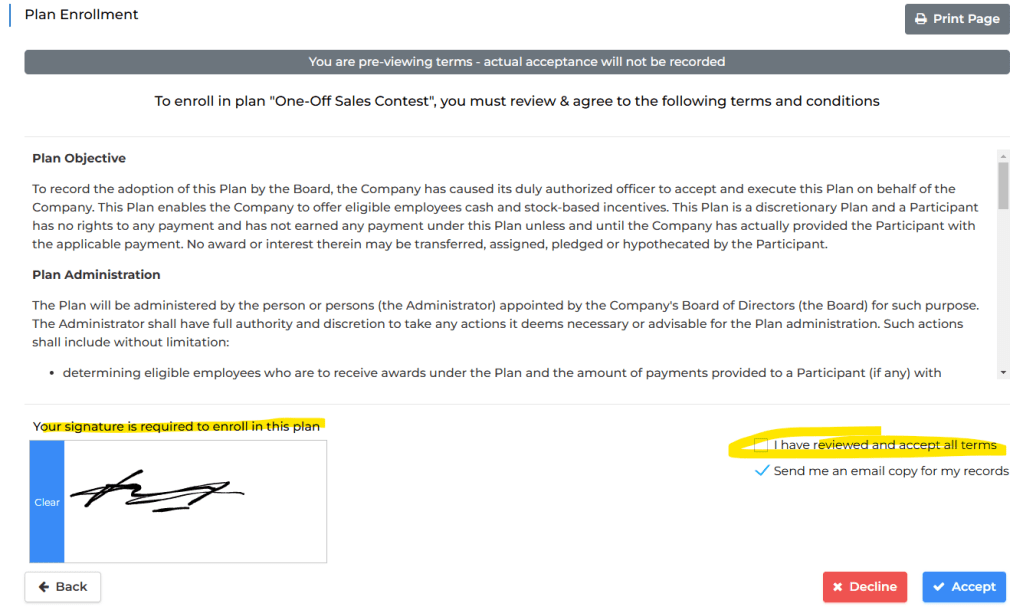

In this example, reps are asked to enroll when accessing their online commission statement:

In this example, reps are asked to review terms, check a checkbox, and e-sign:

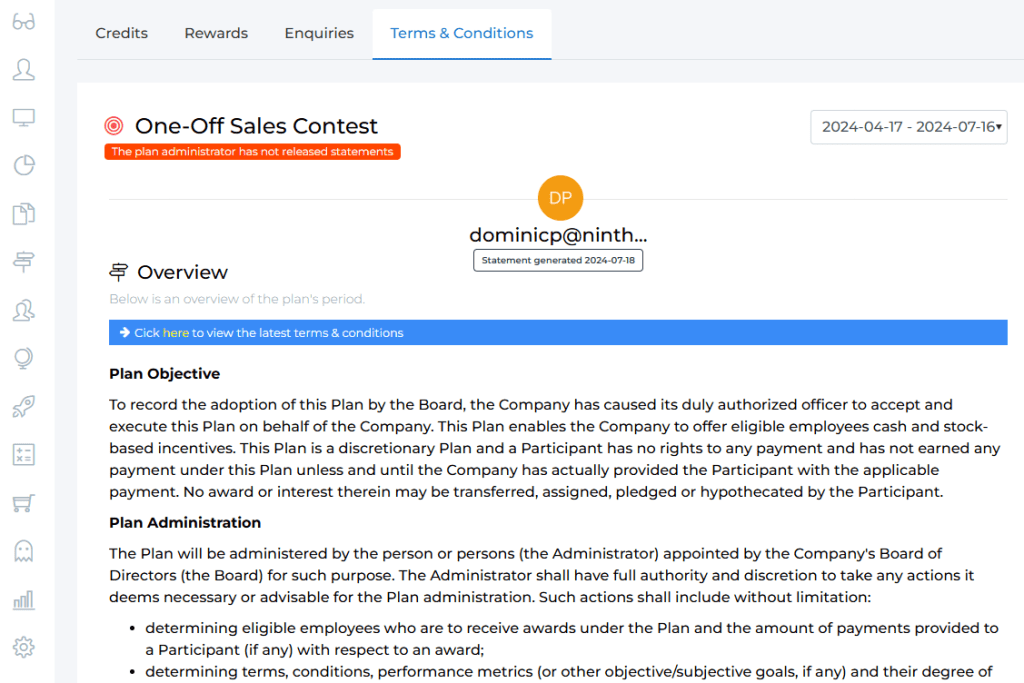

They can view accepted terms and conditions directly from their commission dashboard (including changes made to terms):

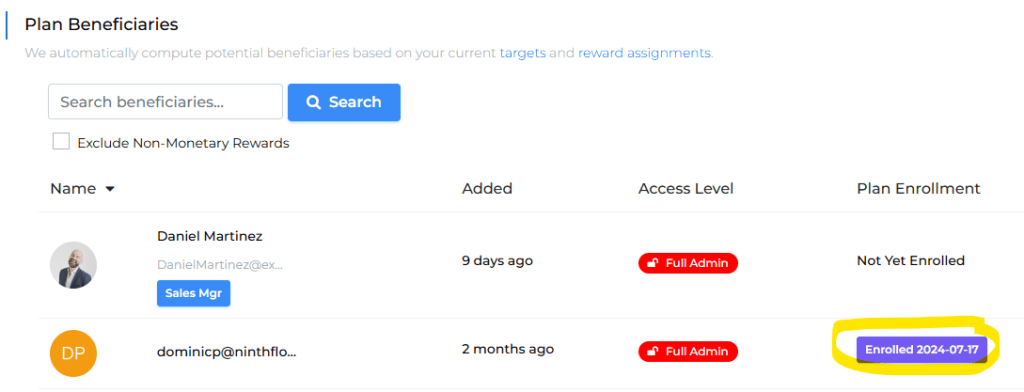

On the admin side of things, we can see who enrolled, and review their acceptance.

Requiring Managers to Approve Commission Statements

Another easy way to bulletproof your commission plan is to require sales managers to approve all commission statements. This gives your more experienced sales employee a way to validate commissions before they are paid. This reduces the opportunity for commissions to be paid incorrectly, and to incur (legal) disputes later on.

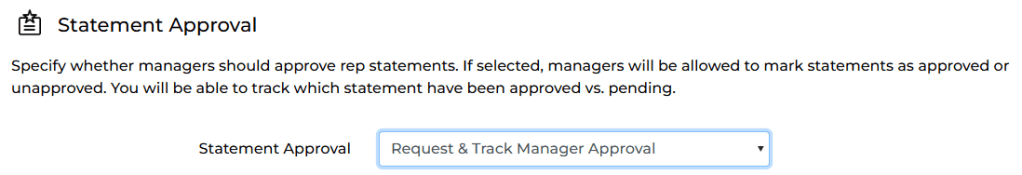

In this example, we are enabling manager approval for rep statements:

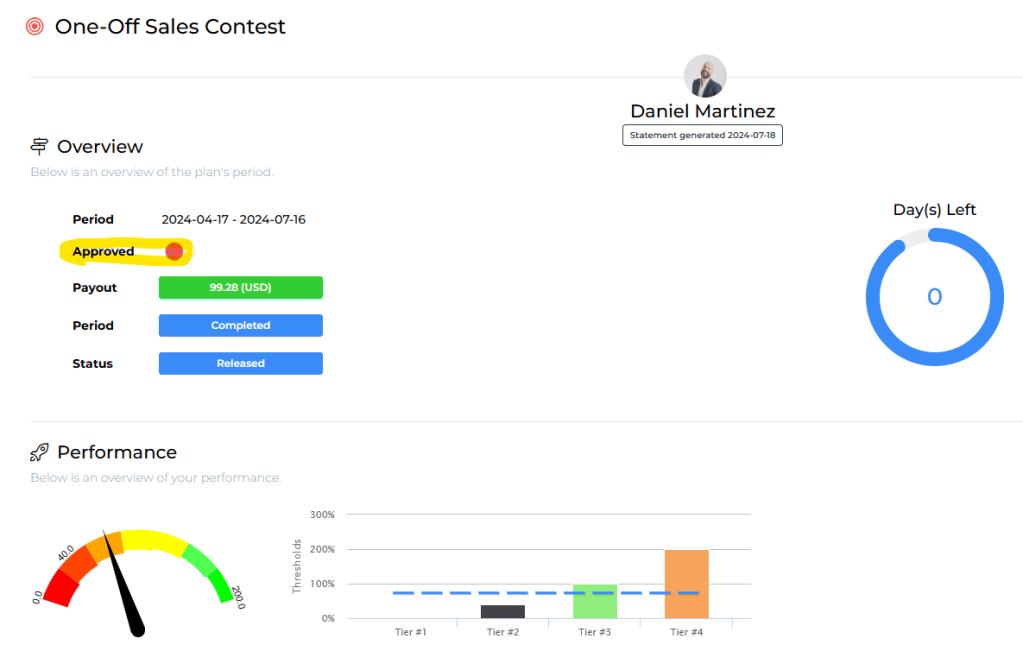

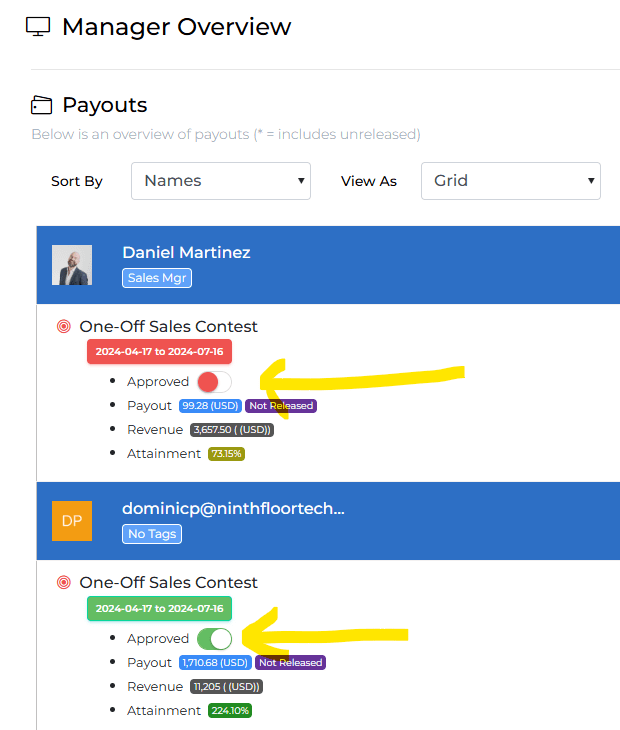

Managers can easily approve commission statements using a toggle-style button:

Here is a manager view with multiple reps selected:

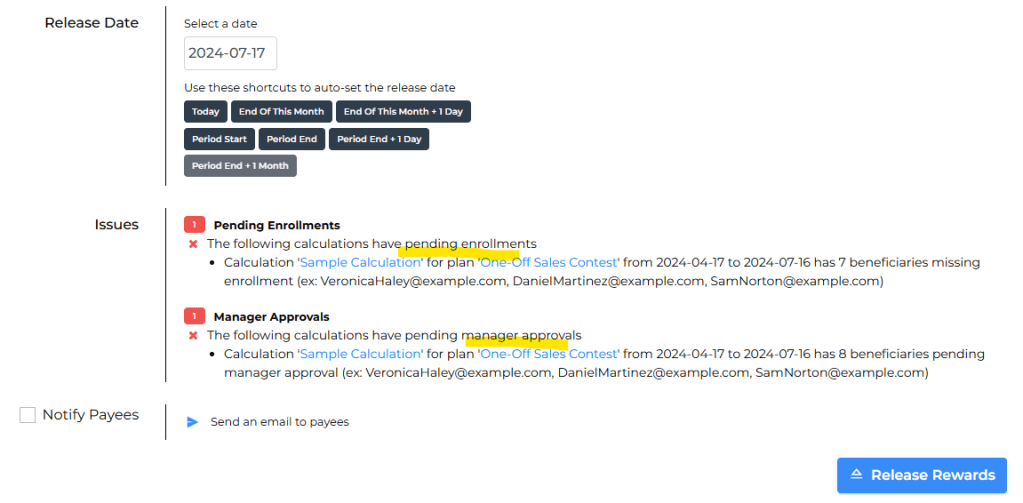

On release, we are alerted of any missing payee enrollment and missing manager approval.

In conclusion

Oracle’s failure to account for some legal aspects of commissions cost them millions!

To reduce legal risk:

- Draft a robust legal agreement, which gives you the authority to make adjustments at any time

- Include provisions for edge cases, such as employee departures, refunds / clawbacks, etc.

- Include a detailed description of plan mechanics (including examples explaining how tiers work)

- Avoid using the terminology of “earned commission” for potential commissions

- Require and track payee acceptance of legal agreements

- Leverage your sales managers to approve statements

Those simple actions can protect your incentive program. For help automating your commissions, visit us online! We’d love to help.